Sunset Boulevard/Corbis Historical via Getty Images

Goldman Sachs says one of the most common client questions it gets is whether the Magnificent 7 can continue to outperform.

Outperformance by the 7 – Apple (AAPL), Amazon (AMZN), Alphabet (GOOG) (GOOGL), Meta (META), Microsoft (MSFT), Nvidia (NVDA), Tesla (TSLA) – has persisted “with the group returning 8% YTD compared with 3% for the S&P 493,” strategist David Kostin wrote in a note. “Investors often ask us whether the group’s 30x P/E multiple is sustainable given rest of the index trades at 18x.”

“As the Dot Com boom showed, continued outperformance requires stocks to exceed the high bar set by consensus.”

“Improving fundamentals, rather than valuation expansion, have driven the bulk of the group’s performance since 2019,” Kostin said. “Looking forward, we expect revenue growth will be the key driver of returns for the Magnificent 7 stocks. Bottom-up consensus expects the seven companies will collectively grow sales at a 12% CAGR through 2026 compared with an 3% CAGR for the remaining 493 companies in the S&P 500 index (SP500) (NYSEARCA:SPY) (IVV) (VOO).”

“However, there is a wide dispersion of consensus growth estimates across the group,” he added. “NVDA is expected to grow sales during the next three years at a blistering 31% annual pace compared with just 6% for AAPL.”

“Estimate revisions during the past six months have also varied considerably: NVDA’s 2024 consensus sales forecast has increased by 57% while TSLA’s has been slashed by 14%.”

Magnificent 7 and Tech Bubble 5

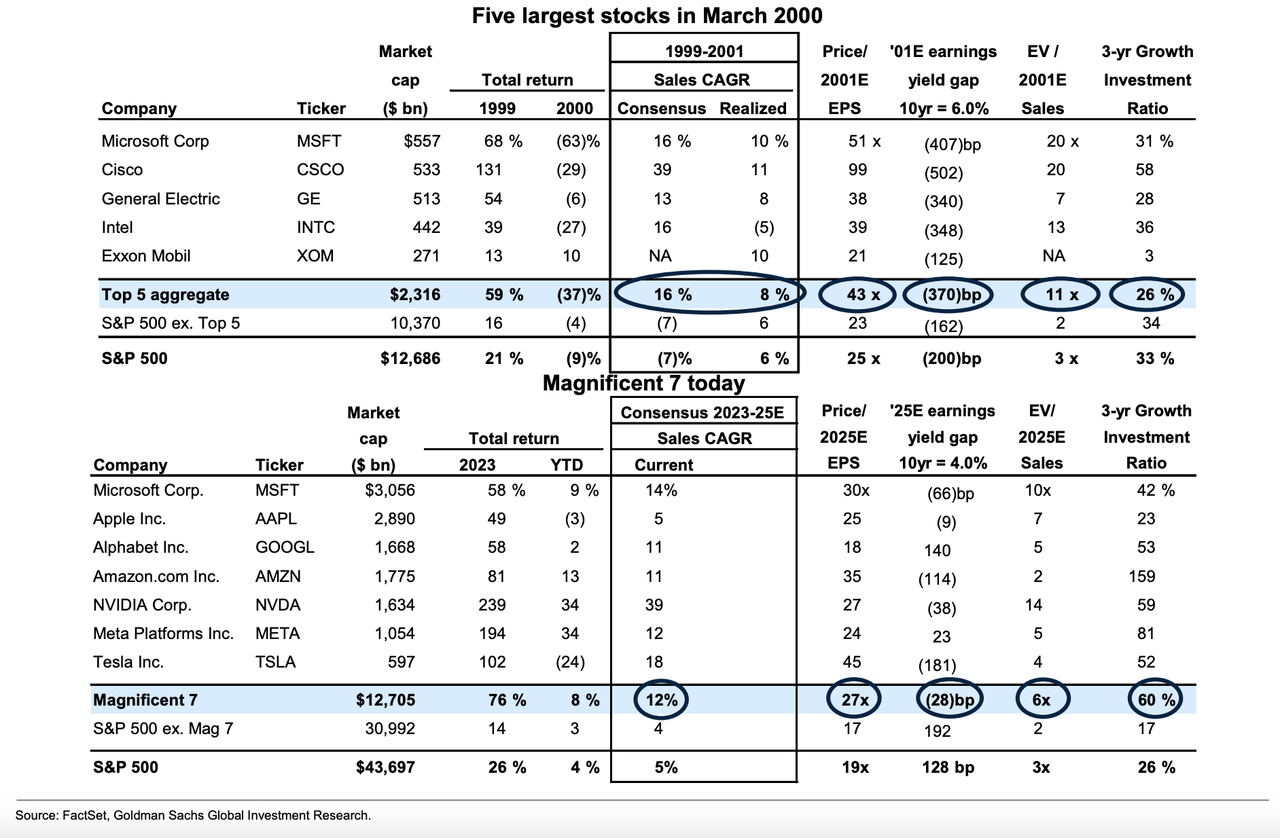

The team also compared the current megacaps with five largest stocks in March 2000, right at the peak of the dotcom bubble – Microsoft, Cisco (CSCO), GE (GE), Intel (INTC) and Exxon Mobil (XOM).

“Importantly, the Tech Bubble shows that investors believe consensus estimates at their own risk,” Kostin said. “In March 2000, MSFT, CSCO, GE, INTC, and XOM were the largest S&P 500 companies, comprising 18% of the index. Consensus then expected the group would grow sales at a 16% CAGR over the coming two years.”

“However, the group fell significantly short, realizing just 8% growth,” he said. “The group went on to underperform the S&P 500 by 21 pp over the next 24 months.”

“One significant difference between the Magnificent 7 and the Tech Bubble 5 is their penchant to re-invest for growth. The Mag 7 re-invests 60% of their cash flow from operations through growth capex and R&D. This reinvestment rate is more than double the 26% of the Tech Bubble 5 and about 3x that of the S&P 493.”

“On an earnings yield gap basis, today’s stocks screen considerably cheaper than the Tech Bubble 5,” Kostin added.