The S&P 500 (SP500) on Friday advanced 2.29% for the week to end at 5,234.18 points, posting gains in four out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) added 2.23% for the week.

The benchmark index surged to its best weekly performance of 2024 and in the process snapped a two-week losing streak. Wednesday and Thursday saw the gauge post back-to-back record intraday and closing highs. The S&P’s (SP500) fellow major averages also jumped, with the Dow (DJI) and the Nasdaq Composite (COMP:IND) posting their best and second-best week of the year.

This week’s gains were almost entirely driven by the latest Federal Reserve monetary policy decision and updated dot plot. The Fed on Wednesday held interest rates steady for a fifth straight meeting.

More importantly, Fed officials bumped up their growth projections in the dot plot while reaffirming an expectation of three rate cuts in 2024. Fed chair Jerome Powell in his post-decision press conference was much more dovish than anticipated, and reiterated that it may be appropriate to likely begin easing rates “at some point” this year.

Market participants were cheered by the updated dot plot and Powell’s relaxed attitude towards the hotter-than-expected inflation reports in January and February. With the uptick in growth projections, hopes are now high that the Fed will be able to deliver a soft landing.

“Overall, the updated (dot plot) reflect an FOMC that believes inflation is on the path back to its 2% target, but that it is likely to be achieved slightly later than previously expected. The timing and degree of Fed easing continues to depend on how inflation and the labor market evolve in the coming months. We’ll get three months of inflation and employment data ahead of the June 12 meeting, the first at which we anticipate the committee will cut the range of its federal funds target,” Wells Fargo said in its weekly economic and financial commentary.

Wednesday’s Fed-driven gains actually saw the benchmark S&P 500 (SP500) breach the historic 5,200 points level for the first time ever. The index has arrived at that mark by late March, much much earlier than year-end estimates of 5,200 set by several major brokerages and research firms.

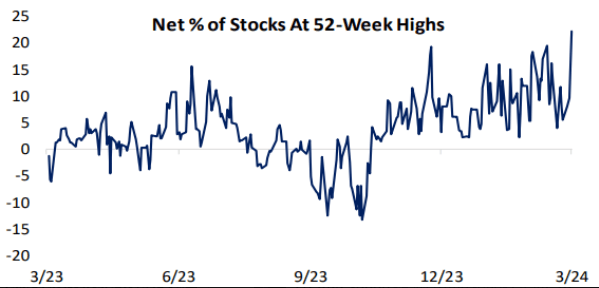

To get a sense of the strength of Wednesday’s post-Fed advance, Bespoke Investment Group noted on X (formerly Twitter) that yesterday “saw a new high in new highs.”

“As shown in the chart, yesterday our reading on stocks making new 52-week highs in the S&P 500 (SP500) broke out above the prior high from late last year,” Bespoke said.

Though the Fed largely dominated headlines this week, there was also a major event on Thursday in the form of Reddit’s (RDDT) hotly anticipated market debut. It was the biggest initial public offering (IPO) by a social media firm since 2019. Class A shares of the company surged 48.4% in their debut day on the New York Stock Exchange, closing at $50.44 versus their IPO price of $34/share and giving the firm a valuation of $8.02B.

This week also saw some earnings reports from some major names: Chinese gaming giant Tencent (OTCPK:TCEHY) (OTCPK:TCTZF) delivered a quarterly revenue miss; Micron Technology’s (MU) earnings and guidance led to Wall Street declaring the memory chipmaker as the next big beneficiary from artificial intelligence; yoga wear maker Lululemon Athletica (LULU) and shoe giant Nike’s (NKE) guidance rattled the apparel and footwear sectors; and global economic bellwether FedEx (FDX) impressed with its Express segment’s results.

Turning to the weekly performance of the S&P 500 (SP500) sectors, all 11 ended in the green with the exception of Real Estate. Heavyweight growth sectors Communication Services and Technology topped the gainers, with the former jumping nearly 5% and the latter gaining about 3%. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from March 15 close to March 22 close:

#1: Communication Services +4.78%, and the Communication Services Select Sector SPDR Fund (XLC) +3.19%.

#2: Information Technology +2.92%, and the Technology Select Sector SPDR ETF (XLK) +2.09%.

#3: Industrials +2.89%, and the Industrial Select Sector SPDR ETF (XLI) +2.59%.

#4: Consumer Discretionary +2.79%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) +2.62%.

#5: Financials +1.86%, and the Financial Select Sector SPDR ETF (XLF) +1.47%.

#6: Energy +1.76%, and the Energy Select Sector SPDR ETF (XLE) +0.88%.

#7: Utilities +1.45%, and the Utilities Select Sector SPDR ETF (XLU) +0.63%.

#8: Materials +0.98%, and the Materials Select Sector SPDR ETF (XLB) +0.62%.

#9: Consumer Staples +0.88%, and the Consumer Staples Select Sector SPDR ETF (XLP) +0.15%.

#10: Health Care +0.38%, and the Health Care Select Sector SPDR ETF (XLV) +0.06%.

#11: Real Estate -0.44%, and the Real Estate Select Sector SPDR ETF (XLRE) -1.08%.

For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.