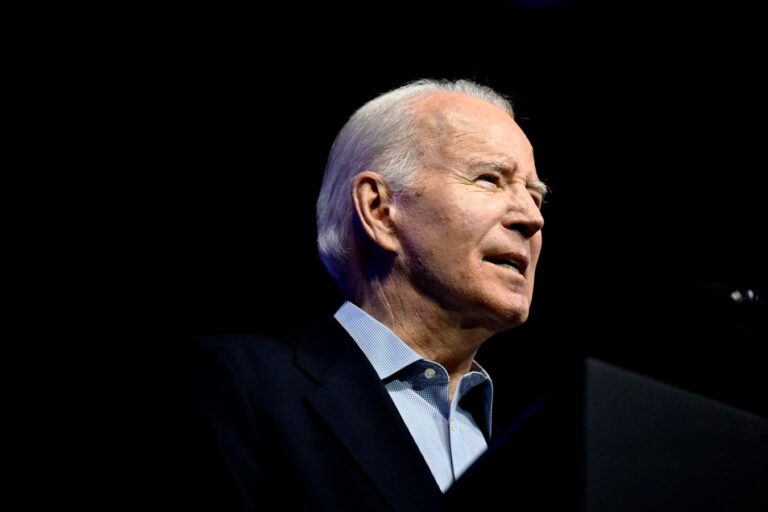

US President Joe Biden delivers remarks in Pueblo, Colorado, on November 29, 2023. The Biden … [+]

The Biden administration released major new details this week on a new student loan forgiveness plan.

The program is designed to provide student debt relief to borrowers in the wake of last summer’s Supreme Court ruling that struck down Biden’s first student loan forgiveness initiative. The new plan is being developed under a different legal authority, and will be targeted to borrowers based on specific circumstances.

The Education Department released draft regulations containing eligibility criteria and proposed student loan forgiveness amounts in advance of a third round of negotiated rulemaking hearings scheduled for next week. These hearings will be one of the last steps before the rules governing the program are finalized next year.

Here’s the latest.

New Biden Student Loan Forgiveness Plan Through Different Legal Authority

The Biden administration’s latest student loan forgiveness plan will be enacted through a federal statute called the Higher Education Act. The HEA’s statutory text includes a so-called “compromise and settlement” authority, which advocates have long argued is a broad legal basis for the administration to cancel student debt on a mass scale. Critics, however, argue that this is too broad of a reading of this provision, which historically has been used in case-by-case settlements of defaulted federal student loans, or to resolve litigation against the Education Department.

Nevertheless, administration officials hope that a new loan forgiveness plan through the HEA will have a better chance of withstanding a legal challenge than Biden’s first first student debt relief initiative. That plan, which would have cancelled $10,000 or $20,000 in federal student loan debt for more than 30 million borrowers, was enacted under the HEROES Act of 2003, a different statute which broadly authorizes the Education Department to waive federal student loan rules in response to a national emergency. The Supreme Court’s conservative majority interpreted the language in the HEROES Act narrowly, and argued that Congress would have had to expressly authorized mass student loan forgiveness in the statutory text for the administration to be able to proceed unilaterally.

The new HEA plan, as proposed by the Biden administraiton, will be more narrowly tailored. Student loan forgiveness will be focused on five broad categories of borrowers. In advance of next week’s negotiated rulemaking hearings, the Education Department released draft regulations on student loan forgiveness eligibility and potential discharge amounts.

Student Loan Forgiveness For Up To $10,000

Under the proposed regulations, borrowers could receive up to $10,000 in student loan forgiveness if their current balance is greater than the amount originally borrowed. This could be due to years of interest accrual, interest capitalization, and negative amortization associated with forbearances or income-driven repayment plans, or excessive fees and collections costs associated with loan default.

The draft regulations propose that, “the Secretary [of Education] may waive the lesser of $10,000 or the amount by which a borrower’s loans cumulatively have a total outstanding balance that exceeds- (1) The original principal balance of the loans for loans disbursed before January 1, 2005; (2) The balance of the loans on the final day of their grace period for loans disbursed on or after January 1, 2005; or (3) The total original principal balance of all loans repaid by a Federal Consolidation Loan or a Direct Consolidation Loan.”

Up To $20,000 In Student Loan Forgiveness

The draft regulations suggest that the amount of student loan forgiveness for borrowers whose current balances exceed their original balances could be even higher under certain circumstances.

If a borrower is enrolled in SAVE, a new income-driven repayment plan recently released by the Biden administration, they could be eligible for up to $20,000 in student loan forgiveness. “The Secretary may waive the lesser of $20,000 or the amount by which a borrower’s loans cumulatively have a total outstanding balance that exceeds— (1) The original principal balance of the loans for loans disbursed before January 1, 2005; (2) The balance of the loans on the final day of their grace period for loans disbursed on or after January 1, 2005; or (3) The total original principal balance of all loans repaid by a Federal Consolidation Loan or a Direct Consolidation Loan if… The borrower is enrolled in the Saving on a Valuable Education Plan.” Borrowers would also be required to be earning less than $125,000 annually if single, or $250,000 if married and filing taxes jointly with their spouse, to qualify.

Borrowers could also be eligible for up to $20,000 in student loan forgiveness if their current balance exceeds their original balance and they have particularly low income. “A borrower is eligible for the waiver described in paragraph (a) of this section if- (1) The borrower is enrolled in an IDR plan… and (2) The borrower’s adjusted gross income or other documentation of income acceptable to the Secretary demonstrates that the borrower’s annual income is equal to or less than 225 percent of the applicable Federal Poverty Guideline.”

Student Loan Forgiveness For Full Balance

The draft regulations identify a number of specific circumstances that can qualify someone for complete student loan forgiveness and a discharge of their entire federal student loan balance. These include:

- A borrower with only undergraduate federal student loans whose loans first entered repayment 20 years ago;

- A borrower with other federal student loans whose loans first entered repayment 25 years ago;

- Those who qualify for student loan forgiveness under other available programs but have not yet applied;

- Former students of colleges and other institutions that engaged in some form of identifiable misconduct. The regulations indicate that this includes schools that have lost their federal financial aid eligibility, have failed to meet an “accountability standard based on student outcomes established under the HEA or its implementing regulations,” or have “failed to deliver sufficient financial value to students, including in situations where the institution or program has engaged in substantial misrepresentations, substantial omissions, misconduct affecting student eligibility, or other similar activities.”

Here’s What’s Next For Biden’s New Student Loan Forgiveness Plan

The draft regulations will be discussed at the upcoming round of negotiated rulemaking, where a committee of stakeholders convene to discuss the rules governing the new student loan forgiveness program. The committee had two prior sets of sessions in October and November.

The committee will also continue to discuss the extent to which personal and financial hardships could be a basis for student loan forgiveness under the new plan. “The Department continues to consider relief options for borrowers experiencing financial hardship that the current loan system does not address, and will be dedicating time to this topic in the upcoming negotiating session,” said the Education Department in a statement on Tuesday.

The stakeholder committee will try to reach consensus on draft regulations at next week’s hearings, which will be held on December 11 and 12. “Consensus means there is no dissent on a given idea,” said the department. “Following this meeting the Department will work on draft rules that will be released for public comment next year. The Department will use any regulatory text that reaches consensus in its draft rules.” Regulatory provisions could change in the course of the rulemaking meeting. For any text that does not reach consensus, the department will have more leeway to craft regulations based on the committee’s discussion.

The new student loan forgiveness plan may not be live and available until 2025. However, it is possible that the Biden administration could use HEA authority to implement the program sooner, potentially sometime in 2024.

Further Student Loan Forgiveness Reading

This Biden Student Loan Forgiveness Opportunity Ends In Just Weeks

Didn’t Get A Student Loan Forgiveness Email? 7 Possible Reasons Why

New Student Loan Forgiveness Application Helps Borrowers With Medical Issues

These Student Loan Forgiveness Updates Will Impact 9 Million Borrowers Or More