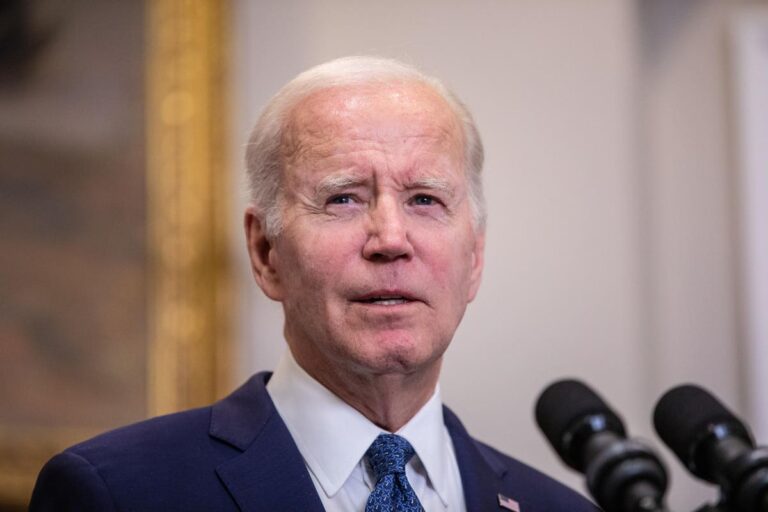

WASHINGTON, DC – MAY 28: U.S. President Joe Biden delivers remarks on a deal struck yesterday with … [+]

President Joe Biden has likely neutralized legislative efforts by congressional Republicans to reverse his sweeping and unprecedented student loan forgiveness plan. But he has also confirmed that the ongoing student loan pause will end later this summer, and millions of borrowers will be required to start making payments again.

Here’s the latest.

Biden Neutralizes Republican-Led Efforts To Repeal Student Loan Forgiveness

Biden appears to have successfully countered two major GOP-led efforts in Congress to repeal his signature student loan forgiveness plan. That plan would allow nearly 40 million borrowers to receive $10,000 or $20,000 in federal student loan forgiveness, an unprecedented initiative.

Congressional Republicans had planned to use the Congressional Review Act, or CRA, to nullify the emergency regulations the Biden administration enacted to establish the program. The House passed the CRA resolution last week, with all Republicans voting in favor of it along with two Democrats. That resolution is now headed to the Senate, where its fate is uncertain. But Biden’s promise last week to veto the CRA resolution will almost certainly keep it from becoming law.

In addition to the CRA effort, GOP leaders hoped to kill Biden’s student loan forgiveness plan through negotiations over raising the nation’s debt ceiling. The House passed a bill in April raising the debt ceiling limit, but repealing Biden’s student debt relief plan. After weeks of negotiations, Biden and House Republican leaders reached an agreement to raise the debt ceiling while preserving his student loan forgiveness plan. While the debt limit agreement has not yet passed Congress, the compromise appears to have shielded borrowers from having Biden’s signature student debt relief plan gutted.

Debt Ceiling Bill Will Codify End Of Student Loan Pause

According to details released over the weekend, the agreement between Biden and House Republicans to raise the debt ceiling will also codify the end of the student loan pause, which has suspended payments and interest on government-held federal student loans since March 2020.

Importantly, this would simply make official the timeline that Biden officials had already confirmed for ending the student loan pause. Top administration officials had repeatedly said that the current extension of the student loan pause would end 60 days after June 30. Codifying this timeline removes the immediate threat of Biden’s most recent extension of the student loan pause being retroactively nullified, which Republicans had tried to do via the CRA resolution and debt ceiling negotiations. Advocates for borrowers had warned of catastrophic consequences if these efforts succeeded, which could have included elimination of student loan forgiveness credit, a reinstatement of previously-discharged student debt, and even potentially retroactive bills sent to borrowers. The agreement also will allow the administration to pause student loan payments again in the future if there is another national emergency.

But codifying the end of the student loan pause would seem to remove any possibility that the administration will extend the current moratorium again. And it means that if Biden’s student loan forgiveness plan is ultimately rejected by the courts, borrowers may have to resume payments anyway — an outcome that Biden officials had said would be unacceptable. Student loan borrower advocacy organizations were critical of the Biden administration for agreeing to this concession.

“The student loan system was broken when President Trump paused student loan bills in the first days of the pandemic and it remains broken today. Folding to pressure from House Republicans by throwing working people back into this broken system is cruel and reckless,” said Student Borrower Protection Center Deputy Executive Director and Managing Counsel Persis Yu in a statement over the weekend. “Senior Biden Administration officials have said repeatedly, resuming loan payments without first cancelling student debt will result in a catastrophic wave of unnecessary borrower distress and default. The government should not be in the business of crushing millions of federal student loan borrowers.”

“The debt-ceiling bill agreement reached by lawmakers is deeply harmful to millions of American families – the worst thing for borrowers would be a sudden and startling restart of payments,” said said Natalia Abrams, President of the Student Debt Crisis Center, in a statement. “Not only does it unnecessarily codify the end of pandemic relief measures that are still desperately needed, but it also sends a disheartening message that the ongoing efforts to assist borrowers are being rolled back before permanent relief promised by the Biden administration has been fully delivered.”

Threats To Student Loan Forgiveness Remain

While Biden appears to have taken off the table a legislative repeal of his signature student loan forgiveness plan, a very real legal threat still remains. Biden’s debt relief plan is currently in the hands of the Supreme Court, which heard oral arguments in February and is expected to issue a ruling in a matter of weeks.

Advocacy organizations for student loan borrowers, and their progressive allies in Congress, have been urging the administration to consider potential backup routes to mass loan forgiveness if the Court strikes down the legal basis for Biden’s current debt relief plan. But publicly, top officials have said there is no fallback option under consideration.

Further Student Loan Forgiveness Reading

Student Loan Forgiveness: Biden Administration Eyes More Updates To Application Process For PSLF

If The Supreme Court Rejects Student Loan Forgiveness Plan, Biden Could Do This

Lowering Student Loan Payments Just Got Easier Amid Uncertainty Over Loan Forgiveness

Student Loan Forgiveness Eligibility Expanded In 3 Ways Under New Account Adjustment Guidance