State Street Global Advisors argued Tuesday that the U.S. economy is far from a recession. Still, the firm acknowledged that topping 2023’s growth levels this year may come as a challenge with the Federal Reserve likely to hold rates higher for longer.

“The US economy isn’t on the brink of recession. Far from it,” Michael Arone, Chief Investment Strategist of State Street Global Advisors, stated.

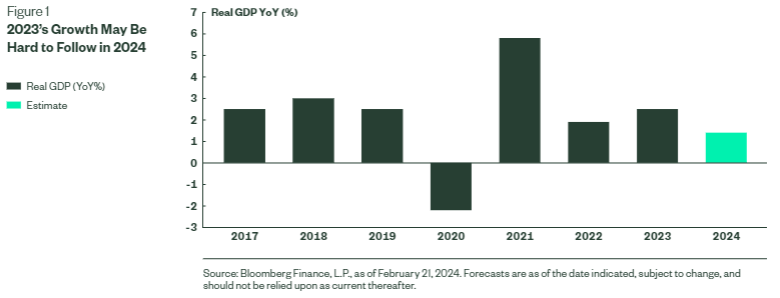

“The latest Federal Reserve Bank of Atlanta GDPNow forecast estimates still-healthy annual GDP growth of 2.9% in the first quarter of 2024.2 But US GDP grew at an annual rate of 4.9% in the third quarter and 3.3% in the fourth quarter of 2023. It’s the decelerating trend in annual GDP growth that may be most alarming. The surprisingly strong pace of US economic growth is expected to cool considerably before year’s end,” Arone added.

See the below chart constructed by State Street Global Advisors:

Supporting the idea of lower growth, the exchange traded fund provider went on to highlight that the Federal Reserve appear unwilling to consider lowering rates until they gain greater confidence that inflation is heading toward 2%. Moreover, this now likely means that monetary policy will remain tighter for “at least several more months, possibly even a couple of quarters.” The investment institution added that these actions too will likely slow the economy.

Looking at Tuesday’s market action, stocks continue to show a lack of direction after a mild slide to start the week. The S&P 500 (NYSEARCA:SPY) (SP500), Dow (DJI) (DIA), and Nasdaq (COMP.IND) (QQQ) opened with a slight move lower.