Dzmitry Dzemidovich/iStock via Getty Images

REITs ended the week in green as the Federal Reserve kept its policy rate unchanged, and a decelerating Consumer Price Index gave a boost to the other major indices.

The Fed kept its policy rate unchanged at 5.0%-5.25% on Wednesday, breaking a streak of 10 straight rate hikes over 14 months. U.S. stocks closed with solid gains on Thursday.

Meanwhile, the CPI edged up 0.1% in May from April, less than +0.2% expected and decelerating from the +0.4% gain in April. U.S. stocks finished higher on Tuesday after economic data showed a moderation in consumer inflation.

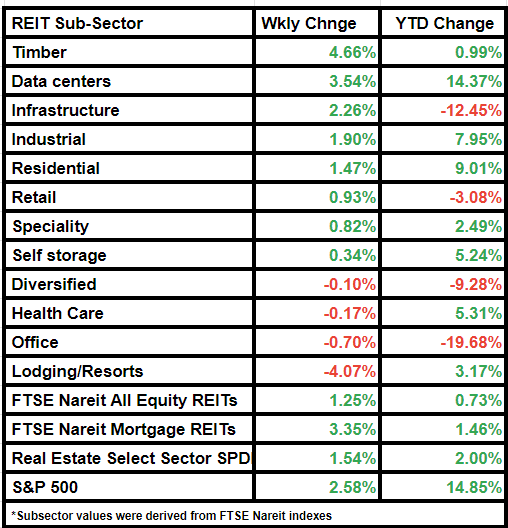

S&P 500 finished the week 2.58% higher, while the FTSE Nareit All Equity REITs gained by 1.25% from last week.

Comparatively, the broader real estate index increased by 1.54%.

The FTSE NAREIT Mortgage REITs index was higher by 3.35% on a weekly basis.

Timber subsector was the biggest gainer among the equity REITs, having finished ~5% higher than last week.

Data centers rose by ~4%.

On the other hand, hotel REITs were major laggards, dropping in value by ~4%.

Here is a look at the subsector performance for this week:

More on REITs:

- Ranking 10 REITs From Highest Quality To Lowest Quality

- Let The REIT Rally Begin!

More on real estate:

- Breaking Point: The Looming Crisis In Commercial Real Estate (And A Look At XLRE)

- Real Estate At 50 Cents On The Dollar