Jefferies analyst Suneet Kamath has re-opened a trading pair of Hold-rated MetLife (NYSE:MET) over Underperform-rated Prudential Financial (NYSE:PRU).

Gaps in both valuation and year-to-date relative performance of the two stocks appear unwarranted based on underlying fundamentals, Kamath said in a note to clients. Year-to-date, MetLife (MET) shares have dropped 24%, while Prudential’s (PRU) have slipped 13%.

While MetLife (MET) has more exposure to CMLs, particularly in office, “we view its stronger excess capital position as a meaningful offset,” the analyst said. Jefferies also expects MetLife to benefit more when sentiment improves to the extent that economic concerns begin to decline.

In business mix, Kamath expects high P/E segments will make up a larger portion of MET’s earnings (27%) relative to low P/E operations (9%) by 2026. And while PRU’s business mix will shift toward higher P/E operations, he estimates they’ll only make up 13% of PRU 2026 earnings, with low P/E operations accounting for 20%.

He estimated MetLife (MET) will be in a much stronger position regarding excess capital than Prudential (PRU).

On credit quality, the two stocks screen similarly. “At a high level, there does not appear to be material differences between the two,” Kamath said.

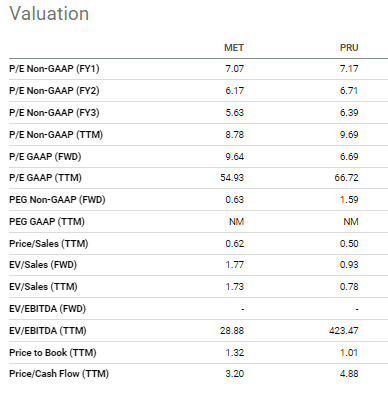

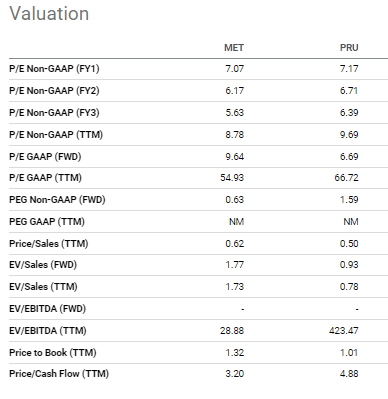

Compare MET’s metrics with PRU here.

Note that the SA Quant system rates MetLife (MET) and Prudential (PRU) both as Holds.