Jira Pliankharom

BMO Capital Markets argued that many high dividend-yielding stocks have fallen into “what we consider oversold levels,” pointing to names like Chevron (NYSE:CVX) and Pfizer (NYSE:PFE) as stocks that could outperform in the near term.

“Over the past 30 years, there have been only two periods where high dividend yielding stocks have performed worse relative to the S&P 500 on a year-over-year basis: the tech bubble and the pandemic,” BMO Capital Markets noted.

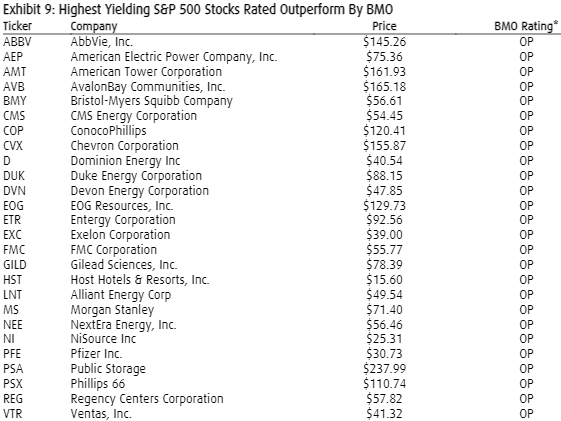

See a table below of all the stocks that are classified as Outperform by BMO analysts and fall within the top 25% of S&P 500 stocks by dividend yield. The list includes of AbbVie Inc. (ABBV), ConocoPhillips (COP), Gilead Sciences (GILD), Bristol-Myers Squibb (BMY), Morgan Stanley (MS), and NextEra Energy (NEE).

Additionally, the financial institution said that it believes the above names have been unjustly punished in 2023 in response to the rise in interest rates and that the general stock weakness offers investors an attractive opportunity to gain exposure.

Year-to-date price action on some of the bigger names mentioned above: CVX -15.1%, PFE -39.5%, ABBV -10.6%, COP +5.5%, GILD -8.2%, MS -10.6%, and NEE -31.6%.