By Gergely Szakacs and Luiza Ilie

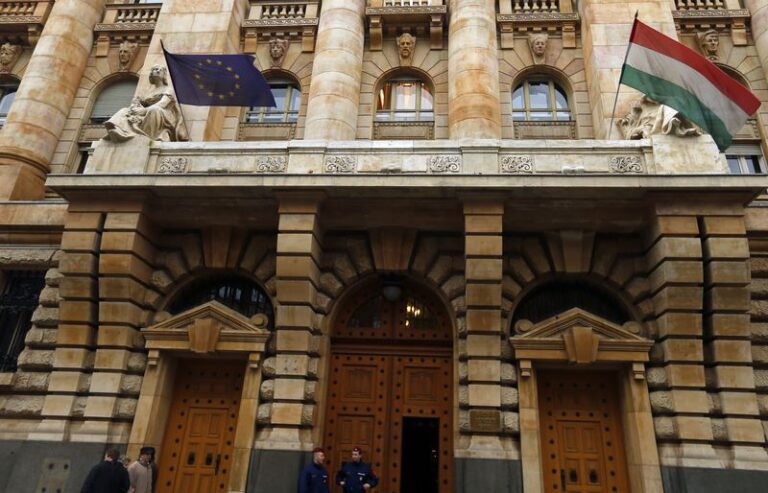

BUDAPEST (Reuters) – Hungary’s central bank warned on Thursday the 2024 budget gap could exceed the government’s recently raised target of 4.5% of gross domestic product, calling for credible fiscal planning to cut market risks for central Europe’s most indebted economy.

Eastern European Union neighbours Hungary and Romania have struggled since the COVID-19 pandemic to control their budget deficits, with their shortfalls averaging about 7% of GDP over the past four years, well above EU average levels.

Data for the first two months showed a rise in the deficit in both countries, leading Hungary to abandon plans to cut the shortfall below the EU’s ceiling of 3% of GDP and raising risks to EU fund flows for Romania, one of the bloc’s poorest members.

“For the debt ratio to decline continuously in 2024 and Hungary’s risk perception to improve, it is also necessary to achieve the set deficit targets in a credible manner,” the National Bank of Hungary said.

“The high inflationary environment over the past two years has led to a significant increase in government interest expenditure, which will continue to be a heavy burden on the budget this year as well.”

It said the shortfall could exceed the EU’s 3% of GDP threshold even in 2026, when nationalist Prime Minister Viktor Orban will face a parliamentary election.

Despite tax hikes at the start of the year, the European Commission has warned that Romania’s shortfall could rise back to 7% of economic output this year, while Hungary’s central bank sees the 2024 budget deficit between 4.5% and 5% of GDP.

“We have highlighted delayed fiscal consolidation among top credit risks for CEE sovereigns for 2024,” Karen Vartapetov, a sovereign ratings analyst at S&P Global Ratings, told Reuters.

“Fiscal consolidation plans will be challenging due to a heavy election calendar, high interest bills and ambitious defence spending commitments,” he said in an emailed response to questions.

Any loss of EU funding due to a failure to meet fiscal rules could hurt economic growth, Vartapetov added.

S&P has projected general government interest spending at nearly a tenth of revenue for Hungary and more than 6% for Romania this year after an inflation surge into the double digits triggered aggressive rate hikes across central Europe.

Hungary’s central bank, which has slashed borrowing costs by 975 basis points since May to 8.25%, slowed the pace of rate cuts this week, while a rise in inflation at the start of 2024 and other risks have so far prevented rate cuts in Romania.

“Hungarian ministers are openly talking about a new deficit target of 4.5% of GDP, which is likely to be officially amended in the spring parliamentary session,” ING economist Peter Virovacz said in a note.

“However, based on our technical projections, we can already see a slippage of around 1.0 to 1.5 ppt even on the soon-to-be-updated deficit target.”