alvarez/E+ via Getty Images

The Industrial Select Sector (XLI) rose for the third week (+2.37%) in a row and so did the SPDR S&P 500 Trust ETF (SPY) (+1.87%), for the week ending May 10.

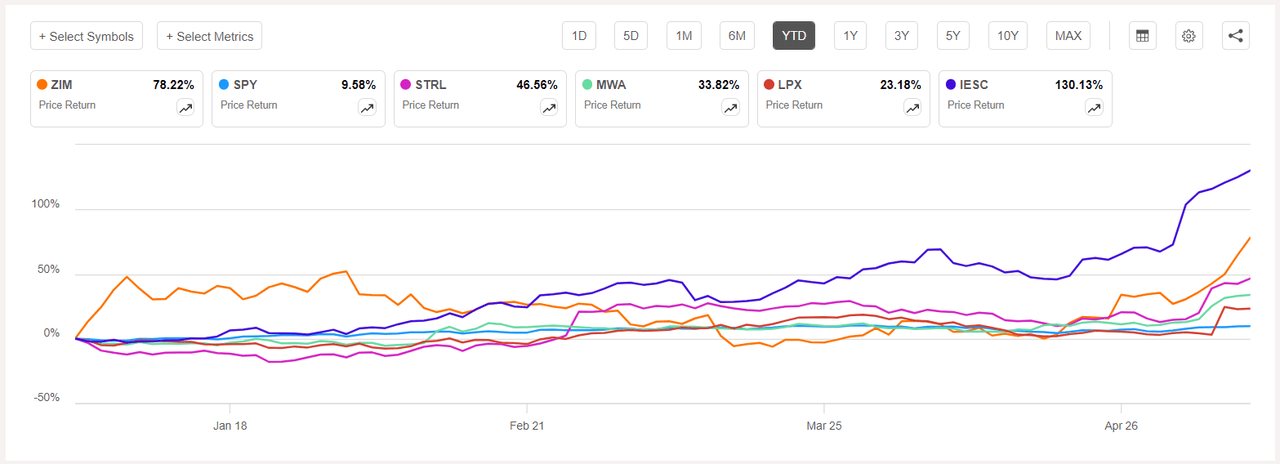

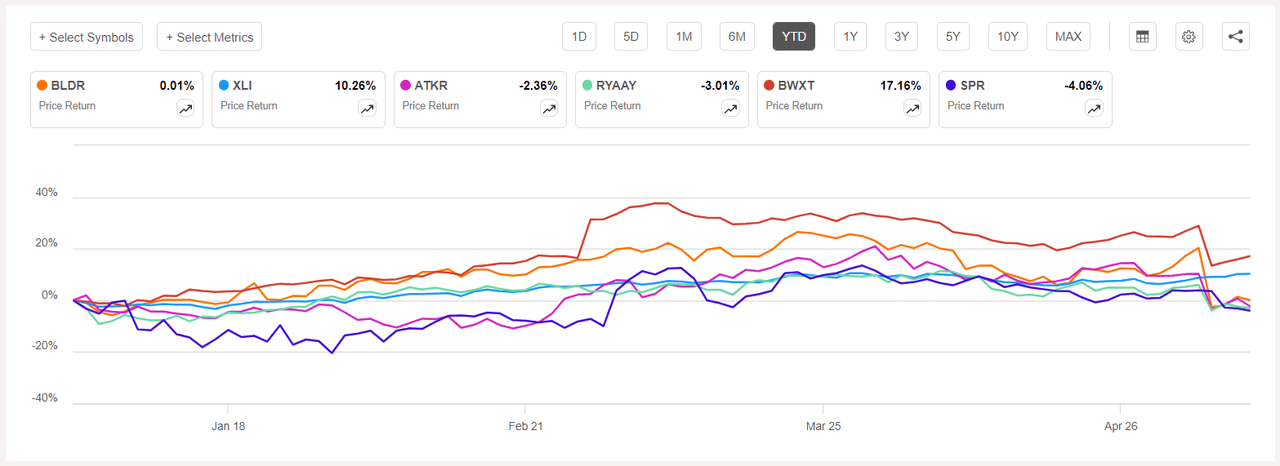

All 11 S&P 500 sectors ended the week in the green. Year-to-date, or YTD, XLI has gained +10.26%, SPY +9.58%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +12% each this week. YTD, all these 5 stocks are in the green.

ZIM Integrated Shipping Services (NYSE:ZIM) +36.57%. The Israeli shipping company’s stock rose throughout the week, with the most on Thursday (+9.88%). YTD, +78.22%.

ZIM has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of D for Profitability and D- for Growth. The average Wall Street Analysts’ Rating agrees and has a Hold rating too, wherein 2 out of 6 analysts tag the stock as such.

Sterling Infrastructure (STRL) +27.40%. The company’s stock surged +15.78% on Tuesday after first quarter revenue (announced Monday postmarket) beat estimates. YTD, +46.56%.

The SA Quant Rating on STRL is Strong Buy with score of A+ for Momentum and C for Valuation. The average Wall Street Analysts’ (total 1 analyst in this case) Rating is Hold.

The chart below shows YTD price-return performance of the top five gainers and SPY:

Mueller Water Products (MWA) +18.73%. Shares of the Atlanta-based company rose +8.82% on Tuesday after second quarter results (announced Monday postmarket) surpassed analysts estimates and the company also raised annual guidance for net sales. YTD, +33.82%.

The SA Quant Rating on MWA is Strong Buy with score of D- for Profitability and B- for Valuation. The average Wall Street Analysts’ Rating is also positive and has a Buy rating, wherein 3 out of 6 analysts view the stock as Strong Buy.

Louisiana-Pacific (LPX) +17.43%. The company, which provides products for home construction, saw its stock soar +20.79% on Wednesday after first quarter results beat estimates and LPX raised its FY24 outlook. YTD, +23.18%.

The SA Quant Rating on LPX is Hold, while the average Wall Street Analysts’ Rating is Buy.

IES Holdings (IESC) +12.96%. Shares of IES, which provides network infrastructure installation services, climbed throughout the week, with the most on Monday (+4.61%). The stock was also among the top fiver gainers last week. YTD, +130.13%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -7% each. YTD, 3 out of these 5 stocks are in the red.

Builders FirstSource (NYSE:BLDR) -14.73%. The Irving, Texas-based company’s stock fell -19.05% on Tuesday following first quarter results and outlook. YTD, +0.01%.

The SA Quant Rating on BLDR is Hold with a factor grade of A- for Profitability and B- for Momentum. The average Wall Street Analysts’ Rating differs and has a Buy rating, wherein 9 out of 16 analysts view the stock as Strong Buy.

Atkore (ATKR) -11.37%. The electrical product maker’s stock declined -12.51% on Tuesday after second quarter revenue missed estimates and the company revised its Adjusted EPS outlook for fiscal full year. YTD, -2.37%.

The SA Quant Rating on ATKR is Hold with score of D for Growth and C+ for Valuation. The average Wall Street Analysts’ Rating is more positive and has a Buy rating, wherein 2 out of 5 analysts tag the stock as Strong Buy.

The chart below shows YTD price-return performance of the worst five decliners and XLI:

Ryanair (RYAAY) -7.80%. The Irish airline stock tumbled -9.33% on Tuesday after CEO Michael O’Leary noted that ticket prices were likely going to rise less this summer than previously expected, according to a report by Reuters. YTD, -3.01%.

The SA Quant Rating on RYAAY is Hold, with a factor grade of A for Profitability and A for Growth. The rating is in contrast to the average Wall Street Analysts’ Rating of Strong Buy rating, wherein 4 out of 5 analysts see the stock as such.

BWX Technologies (BWXT) -7.64%. Shares of the nuclear components maker fell -11.97% on Tuesday despite first quarter results (postmarket Monday) beating estimates. YTD, +17.16%. The SA Quant Rating on BWXT is Hold, while the average Wall Street Analysts’ Rating is Buy.

Spirit AeroSystems (SPR) -7.41%. The aircraft parts maker’s shares dipped the most on Wednesday (-6.11%). On the Tuesday, the company reported first quarter results, wherein Non-GAAP EPS missed estimates. YTD, -4.06%. The SA Quant Rating on SPR is Hold, which differs from the average Wall Street Analysts’ Rating of Buy.