Maxxa_Satori

REITs saw the third straight week of decline as the real estate sector in general continues to suffer a downturn.

The Federal Reserve kept its policy interest rate unchanged at 5.25%-5.50% for a 4th straight meeting. The Federal Open Market Committee said that it does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%.

That declaration “signals a potential return to the ‘higher for longer’ policy,” said Seeking Alpha Analyst Damir Tokic.

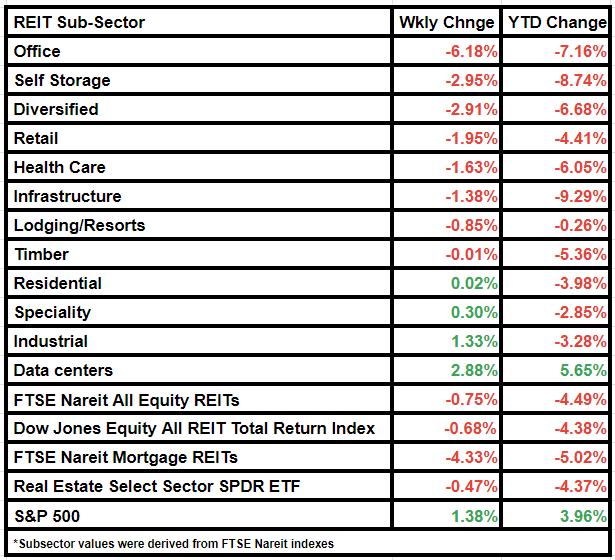

Real estate as a sector is one of the most sensitive to rate hike decisions among the 11 S&P 500 sectors. FTSE Nareit All Equity REITs finished the week 0.75% lower than last week, while the Dow Jones Equity All REIT Total Return Index fell by 0.68%.

Real Estate Select Sector SPDR ETF, which tracks the S&P 500 real estate stocks, was down by 0.47% W/W and 4.37% YTD. FTSE Nareit Mortgage REITs index declined by 4.33% from a week ago.

Comparatively, other major indices continued to push up from the beginning of 2024, with the S&P 500 closing 1.38% higher than last week.

On the earnings side, REITs delivered mixed Q4 results this week. Alexandria Real Estate Equities (ARE) earnings slightly missed the Wall Street consensus even as revenue exceeded expectations, but the Office REIT’s 2024 guidance midpoint slightly exceeds consensus. Meanwhile, Two Harbors Investment (TWO) reported adjusted earnings that were hurt by market-driven value changes in volatile markets against a high interest rate backdrop.

Dynex Capital’s (DX) results came in strong, while Equity Residential (EQR) turned in earnings that matched the average analyst estimate. Boston Properties (BXP) posted above-consensus Q1 2024 guidance for its funds from operations after Q4 FFO topped consensus.

Meanwhile, AvalonBay Communities (AVB) expects Q1 earnings to decline from Q4 results, while the midpoint of its full-year core funds from operations guidance falls under the consensus estimate.

Equity Lifestyle Properties (ELS), Brandywine Realty Trust (BDN) and Camden Property Trust (CPT) largely delivered results that were in-line.

Among subsectors, Office REITs posted the steepest decline, ending the week 6.18% lower from last week. Self Storage, the second biggest laggard, was far behind with a fall of 2.95%.

Data centers stood out among the subsectors, posting a gain of 2.88% on average.

Here is a look at the subsector performance for the week: