Galeanu Mihai

FTSE Russell stated that after a setback in 2022, the global green energy economy has regained momentum in 2023 as green revenues for listed businesses are on pace to exceed $5T by 2025.

“In 2023, the green economy has returned to form, demonstrating remarkable resilience, particularly against the backdrop of a continued high-inflation, high interest rates environment,” FTSE Russell said.

“Despite financial volatility, the green economy has continued to expand steadily and as it is maturing and diversifying, green companies are becoming larger and more investable. By December 2022 (the latest available data), green revenues accounted for 7.2% of total revenues across 15,000 listed companies in the universe.”

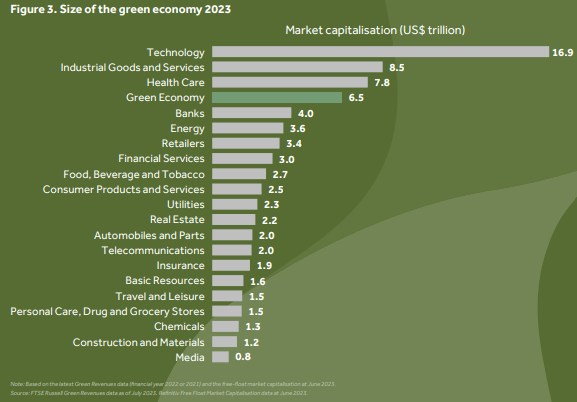

Moreover, the investment management company noted that the market cap for the green economy sits at $6.5T and is approaching 10% of all listed equities. To put that into perspective, if the green economy was its own standalone sector, it would be the fourth largest segment of the global market, ahead of banking, energy, and other industries, the firm stated.

Here’s a chart put together by FTSE Russell showing where the market cap for green economy stocks fits among other segments of the economy:

For investors that want to take a deeper look at the green economy, listed below are ten popular green energy exchange traded funds that can be worth further analysis.

- iShares Global Clean Energy ETF (NASDAQ:ICLN)

- Invesco Solar ETF (NYSEARCA:TAN)

- First Trust NASDAQ Clean Edge Green Energy Index Fund (NASDAQ:QCLN)

- First Trust Nasdaq Clean Edge Smart GRID Infrastructure Index (GRID)

- First Trust Global Wind Energy ETF (NYSEARCA:FAN)

- Invesco Global Clean Energy ETF (PBD)

- SPDR S&P Kensho Clean Power ETF (CNRG)

- BlackRock World ex U.S. Carbon Transition Readiness ETF (LCTD)